WTF is NFT

tldr;

NFTs, or Non-Fungible tokens, are digital assets (commonly image or audio) that are bought and sold on an NFT marketplace with transactions backed by blockchain technology. The blockchain allows for the transactions to be tracked on a distributed “ledger” that publicly details all transactions. Maintaining the blockchain “ledger” is eating up a ton of processing power across the globe and contributes to significant electricity consumption.

Why are people buying NFTs? That seems to be more of a psychology question, but we seem to be in the early “NFT fad” phase, where they’re kind of the hot new thing (think Beanie Babies in 1997) which is why JPEGs of a Tweet and monkeys are selling for millions of dollars.

My Journey: How I Became Rich from Selling NFTs*

As someone who’s never “invested” in cryptocurrency, the NFT journey was quite long. All I was looking to do was make a quick buck by selling my “art” or maybe purchase a few NFTs cheap and let them mature (like the below “Pizzas on Stick” or “Pizza Greek #42”).

Getting set up took a few steps:

-

Create a Coinbase account to enable buying and selling of cryptocurrency.

Add money to Coinbase, and don’t forget about the fee!

-

Create a Coinbase Wallet account so you can buy and sell on an NFT marketplace.

Migrating your money from Coinbase to Coinbase Wallet costs a fee!

-

Find an NFT on OpenSea and purchase, OR mint your own NFT and sell it on OpenSea.

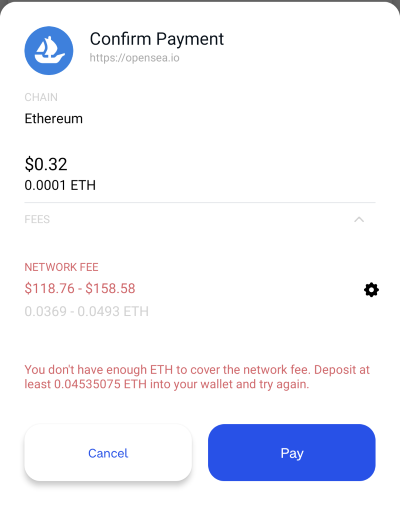

When buying, there’s a fee that also increases depending on how fast you want the transaction processed. When selling, there’s a fee depending on the blockchain used.

Not sure if you noticed, but the common theme was “fees”. It cost around $8 USD just to get through step #1 and #2 – a small price to pay, I guess. Frankly, I never made it past #3 as it costs too much money to actually purchase an NFT ($118.76 to $158.58 network fee for a $0.32 NFT when I tried). Rather than buying, I created a few NFTs – I currently have two in the OpenSea marketplace (Pumpkin Spice #001 and Pumpkin Spice #002).

In general, my observations fed into my belief that the current NFT craze is short-lived and we’re yet to figure out practical, real-world applications of it.

Environmental Impact

As eluded to in the introduction, there’s a significant environmental impact from the processing of cryptocurrencies.

The findings of this study showed that by 2028, the amount of cryptocurrencies market value needed to support economic activities would expand from current $240 billion to a range between $2.4 trillion to $2.9 trillion. The rising electricity requirements to produce cryptocurrencies could lead to likely electricity consumption of 293TWh (equivalent to 1 % of US energy consumed in 2018). This electricity consumption level would generate electricity costs ranging between $23 to $57 billion per year and carbon emissions ranging between 53 to 63.6 MtCO2.

MARTYNOV, OLGA. 2020. Sustainability Analysis of Cryptocurrencies Based on Projected Return on Investment and Environmental Impact. Master’s thesis, Harvard Extension School.

Given the current “value” the platform is providing, I’m just not convinced it’s worth it. There’s more sustainable approaches being researched but is there an incentive to invest in the technology for practical applications, or do we ride the NFT wave out?

Practical Application

Buying and selling of random, low-quality images does not feel like the sustainable future for NFTs. The images bought and sold today don’t seem to have any value beyond the hype.

Assuming we’re okay with the environmental impact the blockchain technology is having, I feel there is potential in the gaming industry. Because NFT represents any digital asset, not just pictures of Tweets and monkeys, it could be used to represent in-game items.

Image a game like World of Warcraft, where when any common weapon (like a sword) is issues to any player is actually unique. Rather than these assets being interchangeable, they’re minted on the blockchain and this specific item tracks properties, like number of kills and the attack slowly increases over time. Maybe this item could also be named, “Pokey the Sword”, and all of these properties are attached to the NFT. This asset would slowly become “unique” and gain value within the World of Warcraft community. The asst could then be bought and sold outside of the World of Warcraft ecosystem, because it hs a real-world identifier.

Now extrapolate this to any game, like a gun Call of Duty, that could even transcend gaming platforms or even games themselves. An asset that isn’t specific to PS5 vs Xbox…or an asset that could be used in multiple iterations of Call of Duty. Providing the ability for someone to invest their time into an asset, and it gains value inside and even outside of the game it originates feels like a realistic application of NFT.

I’ve heard some applications of cross-company implementations where Nike shoes could be purchased and used within a game. I understand this idea from a marketing and brand loyalty perspective, but I don’t see as much of an incentive for the gamers that are investing all their time in games.

There’s also a few NFT-based games that look interesting, like Neon District and Treeverse, but the experiences seem to be NFT-first, rather than an established franchised adopting NFT.

Conclusion

I’m interested to see how NFTs progress and an particularity interested in their applications in the gaming industry. As for getting rich quick, I feel like spending a few hundred dollars in the hopes to make millions isn’t a great investment. Please buy my NFT.